About The Budget

Where the money comes from

23% State and County Support

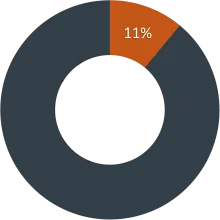

11% - State Endowment

In 1839, when Texas was still a republic, its congress set aside 221,400 acres to fund higher education. In the state’s constitution of 1876, the land allocation was increased and dedicated to The University of Texas at Austin. Today this land encompasses 2.1 million acres of West Texas which is then leased to oil and gas companies, cattle ranchers, and wind farms to generate income. A portion of the income is ultimately distributed to The University of Texas System and the Texas A&M University System, 2/3 and 1/3 respectively, including for the support and maintenance of UT Austin. The exact amount that can be distributed – known as the Available University Fund – is set by the UT System Board of Regents.

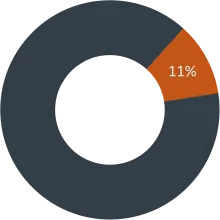

11% - State General Revenue

Every two years the Legislature appropriates General Revenue to the university through the state’s General Appropriations Act. Texas supports higher education through various funding formulas primarily based on student enrollment. Formula funding represents more than two-thirds of the university’s state General Revenue, while additional appropriations cover non-formula support.

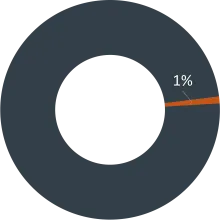

1% - County Support

Property owners within Travis County contribute to the university in the form of property tax to support the creation and operation of the Dell Medical School. This tax generates approximately $35 million per year and is channeled through the county’s hospital district, Central Health.

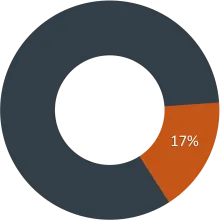

17% - Tuition

Tuition from undergraduate and graduate students at UT Austin exceeds $700 million. Less than half the cost of education is covered by tuition, with extensive support provided through scholarships and state programs.

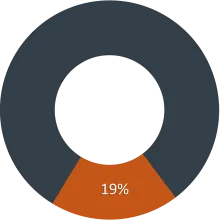

19% - Grants and Contracts (Sponsored Projects)

The university secures over $600 million a year in research grants and contracts, known as sponsored projects. In 2017, it secured a contract worth up to $1.1 billion to bolster national security efforts, ranking among the top research recipients.

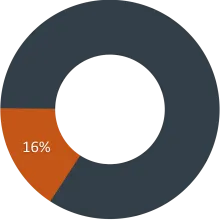

16% - Self-Supporting

Self-supporting units—often referred to as “Auxiliary Enterprises”—fund themselves entirely. This category includes Athletics, University Housing and Dining, The Erwin Center, Parking and Transportation, and Recreational Sports.

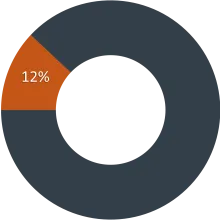

12% - Gifts

More than $400 million from alumni, friends, foundations, and corporations provide critical funding that supports recruitment, facilities, and academic initiatives at UT Austin.

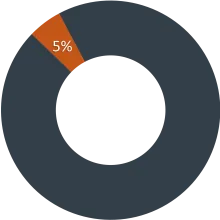

5% - Enhanced Academic Experience

Beyond core academics and research, UT Austin offers enhanced experiences through programs like Executive MBA, Study Abroad, Texas Global Programs, and the UT Elementary School. These initiatives generate tuition and fees that help offset costs.

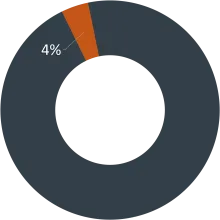

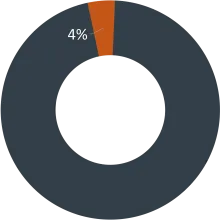

4% - Indirect Cost on Sponsored Projects

A portion of externally funded research is allocated to cover indirect costs such as utilities, custodial services, libraries, and general administrative expenses.

4% - Other Funding

The remaining portion of the university’s budget comes from diverse sources such as intellectual property income, fees from auxiliary enterprises, and carryover funds from previous years.

Where the money goes

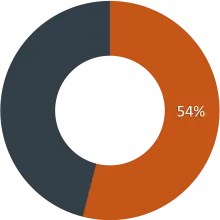

54% - Salaries and Benefits

UT Austin’s largest expense is its people. Salaries for faculty, researchers, and staff, along with their benefits, constitute a major share of the operating budget.

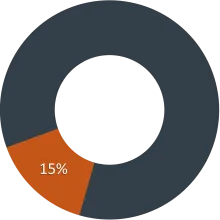

15% - University Operating Expenses

Covering maintenance, custodial services, equipment, safety, and administrative operations, this segment funds the upkeep of UT Austin’s historic and modern facilities across multiple campuses.

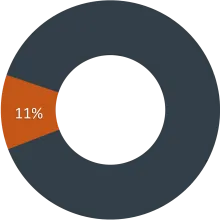

11% - Scholarships & Financial Aid

With over $400 million awarded annually, UT Austin supports students through merit and need-based scholarships, including the Texas Advance Commitment, Endowed Scholarships, and various college-specific awards.

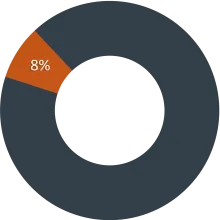

8% - Academic and Research Resources & Reserves

Investment in academic and research priorities includes seed funding for new programs, equipment acquisitions, and enhanced library resources to maintain a competitive edge in education and innovation.

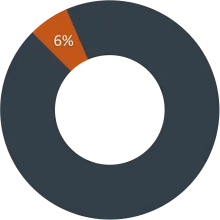

6% - Facilities – Capital, Debt Service, & Utilities

New construction and the maintenance of existing facilities, including utilities across UT Austin’s campuses, are funded through this portion of the budget.

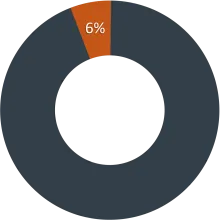

6% - Self-Supporting Operating Expenses

Auxiliary units such as Athletics and University Housing manage their own facilities, funding maintenance, custodial services, equipment, and security entirely through self-generated revenue.

Budget Office Contact Information

Budget Office Org Chart:

Location:

Main 106

110 Inner Campus Dr.

Austin, Texas 78712

Address:

Budget Office

The University of Texas at Austin

110 Inner Campus Dr.

Campus Mail Stop G0600

Austin, Texas 78712